People’s Republic of China (PRC)

New in Force Structure:

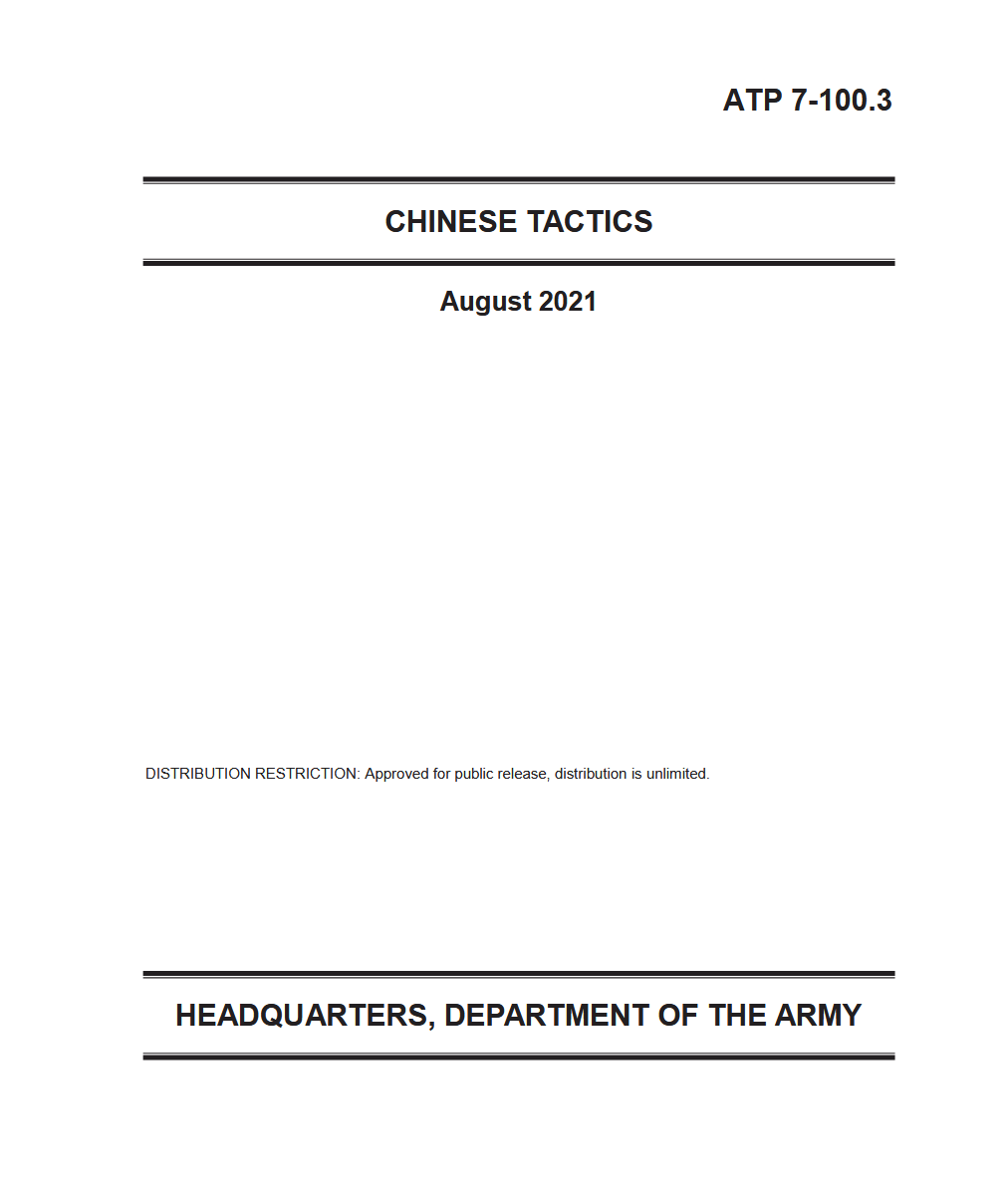

The PLA’s new Amphibious Combined Arms Brigades

China's New Battle Tank adapts to drone environment

**

China's New Battle Tank adapts to drone environment **

DoD China Military Power Report (CMPR).

Strategic intent. Beijing seeks “national rejuvenation” by 2049, with a fully modernized force by 2035 and a 2027 milestone to make the PLA a more credible tool for Taiwan coercion/contingency. The PRC is expanding military, economic, and informational levers to reshape the regional order and constrain U.S. access (“counter-intervention”). U.S. Department of Defense+1

Force-wide reforms. In April 2024 the PRC disbanded the Strategic Support Force and stood up separate Aerospace, Cyber Space, and Information Support forces (plus the Joint Logistics Support Force) to sharpen space, cyber, electronic/information warfare, and joint C2. U.S. Department of Defense

Navy (PLAN). Numerically the world’s largest: 370+ battle-force ships (140+ major surface combatants) as of mid-2024; the fleet is projected to ~395 by 2025 and ~435 by 2030 (growth concentrated in cruisers, destroyers, and frigates). Carrier operations and blue-water logistics continue to expand. U.S. Department of Defense

Rocket Force (PLARF). Three new ICBM silo fields (≥300 silos) are complete; DF-26 IRBMs continue to expand while DF-21Cs are phased out. DoD highlights rapid improvements in conventional precision strike and nuclear “strategic deterrence.” U.S. Department of Defense+1

Air & missile forces. The PLAAF fields the J-20 stealth fighter in growing numbers (production capacity increasing) and continues to integrate very-long-range AAMs (PL-17). Airpower is increasingly joint, with emphasis on long-range ISR/strike and air defense. U.S. Department of Defense

Nuclear forces. DoD assesses the PRC surpassed 600 operational nuclear warheads in 2024 and is on track for 1,000+ by 2030, with higher readiness and broader yield options; growth is enabled by new plutonium production (e.g., CFR-600). DIA’s 2025 threat assessment aligns. U.S. Department of Defense+1House Armed Services Committee

Taiwan pressure & regional ops. The PLA has normalized presence and coercive activities around Taiwan (crossings of the centerline/ADIZ; large-scale “Joint Sword” exercises) and sustains far-seas deployments and Gulf of Aden rotations. U.S. Department of Defense

Defense industry & tech. DoD judges China nearly self-sufficient in naval shipbuilding and a leader in hypersonic missile development; corruption remains a drag but not a stopper. U.S. Department of Defense

What this implies for 2026 (DoD-based trajectory)

DoD provides explicit targets for 2025 and 2030. The 2026 points below are near-term projections inferred from those DoD baselines and stated trends.

Fleet size & posture. With 395 ships projected for 2025 and 435 by 2030, the PLAN’s battle force is likely just over 400 ships in 2026, driven by continued deliveries of RENHAI cruisers, LUYANG III destroyers, and JIANGKAI-series frigates. Expect more frequent multi-carrier ops, long-range cruises, and sustained logistics capacity. (Projection based on CMPR growth path.) U.S. Department of Defense

Nuclear arsenal & readiness. Warhead numbers will continue rising beyond the 600+ (2024) level by 2026, with more warheads at higher readiness and further silo/missile integration—consistent with DoD/DIA’s glide path to 2030. (Projection from DoD/DIA.) U.S. Department of DefenseHouse Armed Services Committee

Rocket Force capacity. DF-26 inventories grow and replace legacy DF-21C roles; increasing dual-capability flexibility, longer-range conventional precision strike, and improved reload/dispersion practices. (Projection from PLARF trends.) U.S. Department of Defense

Airpower & A2/AD. J-20 fleet size and capability expand (domestic engines, weapons carriage), improving counter-air and long-range engagement. Integrated air defenses, ISR, and long-range SAMs deepen anti-access envelopes along the coast and into the Western Pacific. (Projection from CMPR production notes.) U.S. Department of Defense

Information/cyber/space. The post-SSF reorganization should be institutionalized by 2026, yielding clearer command relationships and better support to joint targeting, electronic warfare, and space-enabled C2. (Projection from 2024 restructuring.) U.S. Department of Defense

Taiwan & gray-zone ops. Expect persistent multi-axis pressure—air/naval sorties, maritime law-enforcement presence, and periodic large-scale joint exercises—aimed at normalization of PLA activity around the island while avoiding uncontrolled escalation.

Gray Zone Operations are activities that lie in the “operational space between peace and war”. More and more, we are seeing China exert control in the region while largely avoiding a conventional response from the international community. This is because China has mastered the art of employing gray zone operations which skirt the boundaries of kinetic actions. This discussion covers the PRC's unique approach through the use of civilian militia and the China Coast Guard to enforce regional objectives.

Taiwan’s ports are of vital importance because Taiwan may not be capable of surviving a blockade for more than a few months if the PRC were to execute a blockade. If access to these ports is blocked, Taiwan will be unable to support itself unassisted for more than 90 days according to many experts. Taiwan’s ports handle the vast majority of trade, including trans-shipments between other economies. Also important is the economic impact, Taiwan’s economy would suffer greatly in the event of a blockade or even a quarantine as this would seriously damage all of their export-oriented industries. In this segment, I will explore these vulnerabilities and discuss the two most likely courses of action that the PRC may execute if they decide to take drastic measures to reclaim Taiwan.